Difference between revisions of "Energy Storage 101"

| Line 1: | Line 1: | ||

<div class="responsivediv"> | <div class="responsivediv"> | ||

[[File:ES 101 Intro.PNG|right|Energy Storage 101. This content covers introductory energy storage material on [[Energy Storage 101/Drivers and Big Picture|industry drivers]], [[Energy Storage 101/Economics|economics]], [[Energy Storage 101/Technologies|technologies]], and [[Energy Storage 101/Integration and Deployment|integration and deployment]].|class=responsiveimg]] | [[File:ES 101 Intro.PNG|right|456px|Energy Storage 101. This content covers introductory energy storage material on [[Energy Storage 101/Drivers and Big Picture|industry drivers]], [[Energy Storage 101/Economics|economics]], [[Energy Storage 101/Technologies|technologies]], and [[Energy Storage 101/Integration and Deployment|integration and deployment]].|class=responsiveimg]] | ||

</div> | </div> | ||

Revision as of 10:33, 14 May 2024

This content is intended to provide an introductory overview to the industry drivers of energy storage, energy storage technologies, economics, and integration and deployment considerations. ES 101 may be helpful for bringing new stakeholders up to speed on the energy storage landscape.

The content is based on EPRI's Energy Storage 101 training courses. We will continue to build out the content with up-to-date content. If you have any suggestions, please email Erin Minear.

Drivers for Energy Storage

There are various factors and forces that are currently driving the adoption of energy storage and influencing the current energy storage landscape throughout the world.

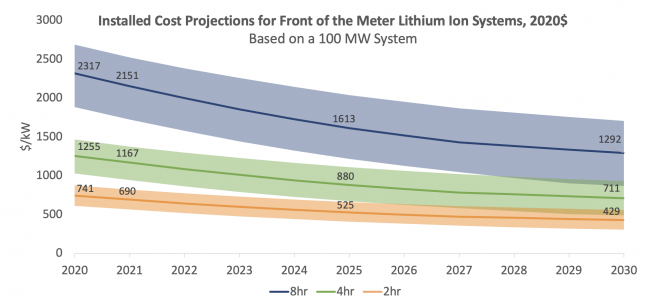

Decreases in Technology Costs

Massive research and development investment and manufacturing scale-up has driven costs down for lithium ion battery storage. This was initially driven by the consumer electronics market (e.g. cell phones and laptops) and more recently accelerated by the electric vehicle market. There has been an almost 90% reduction in $/kWh cost in the last decade and lithium ion costs are expected to continue to decrease with additional manufacturing improvements and economies of scale. Solar and wind technology cost reductions are also driving deployment of energy storage for hybrid applications. Bloomberg New Energy Finance projects 2030 lithium ion pack costs at $62/kWh based on observed prices and an 18% learning rate.[1]

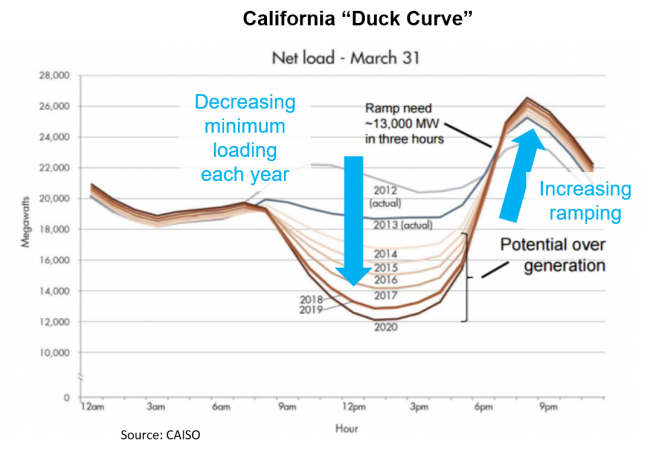

Increasing Renewable Generation

Solar photovoltaic (PV) is driving midday over generation and increased evening ramping requirements which provides a value stream for flexible energy storage. As more solar comes online, the effective net load in the middle of the day decreases. Similarly, wind energy is also driving flexibility needs.

Evolving Utility Needs

- The grid infrastructure (generation, transmission, and distribution) is sized for infrequent peak needs and therefore most assets are under-utilized most of the time. Energy storage can support peak load reduction to provide significant cost reduction opportunity to electricity customers.

- Utility asset infrastructure is aging and peak load reduction may extend asset life and offer opportunity to consider investment in new technologies.

- Peaker plants are only used a fraction of hours per year and energy storage is being considered as peaking capacity in generation planning. Battery storage is already being deployed for this application and as costs decrease they may be cost competitive with combustion turbines in the next decade. When accounting for operational benefits, the crossover point on cost may be sooner.

Increasing Utility Customer Choice and Engagement

Customers (residential, commercial, industrial) are considering energy storage for:

- Bill savings

- Increased energy independence

- Renewable energy goals

- Backup premise or critical loads

Policy and Regulatory Changes

U.S. Federal Policy

In the last decade there has been a shift in policy towards energy storage. At the federal level, FERC has issued several orders as outline below to support energy storage in markets.

1Lawrence Berkeley National Lab, Hybrid Power Plants: Status of Installed and Proposed Projects.[4]

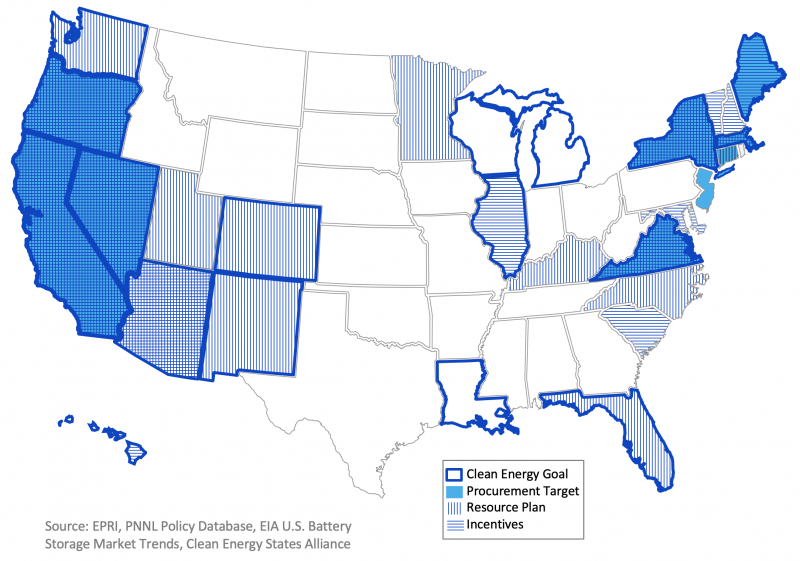

U.S. State Policy

At the state level, there has been an expanding number of policies to address energy storage in various ways.

- Clean Energy Goals: Carbon-free, renewable portfolio standards, and net-zero goals.

- Procurement Targets: Regulators or legislators set procurement goals and mandates requiring utilities to directly procure or contract storage.

- Resource Plans: State agencies or regulators fund studies or direct utilities to create an energy plan with consideration of storage. Many utilities and states included storage in their resource plan even if not directed to by regulators (not shown on the figure).

- Incentives: Legislators created economic incentives (e.g., rebates or subsidies) for deploying storage.

Current Status and Future Outlook

By the end of 2018, battery energy storage had been deployed in nearly every region of the U.S. under a variety of ownership models. IPPs owned most of the power capacity, providing market services for ISOs like PJM and ERCOT. Conversely, IOUs owned most of the energy capacity, serving needs such as renewable firming and load shifting in places like California and New England. [6]

Energy Storage Deployment Trends

Since 2018, the size and duration of projects has generally increased. Announcements for new battery energy storage sites planned over the next 2-3 years have grown — now, individual sites may host hundreds of megawatts and nearly a gigawatt-hour each.

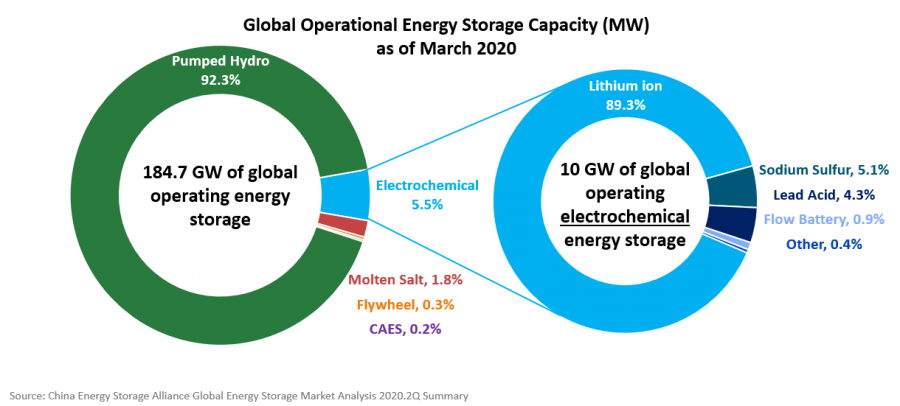

Deployments by Technology

References

- ↑ BloombergNEF: "A Behind the Scenes Take on Lithium-ion Battery Prices"

- ↑ "EPRI Battery Energy Storage Lifecyle Cost Assessment Summary: 2020"

- ↑ California Independent System Operator (CAISO): "What the duck curve tells us about managing a green grid"

- ↑ Lawrence Berkeley National Lab, Hybrid Power Plants: Status of Installed and Proposed Projects

- ↑ Pacific Northwest National Laboratory (PNNL): Energy Storage Policy Database

- ↑ Helman U, Kaun B, and Stekli J (2020) "Development of Long-Duration Energy Storage Projects in Electric Power Systems in the United States: A Survey of Factors Which Are Shaping the Market"

- ↑ China Energy Storage Alliance (CNESA): "Global Energy Storage Market Analysis—2020.Q2 (Summary)"

Energy Storage Economics

Energy Storage Technologies

- Definition of energy storage

- Characteristics of energy storage: How to understand and consider performance

- Survey of technologies: Different storage mediums

Energy Storage Integration and Deployment

Additional Resources