Difference between revisions of "Energy Storage 101/Drivers and Big Picture"

| Line 5: | Line 5: | ||

=Decreases in Technology Costs= | =Decreases in Technology Costs= | ||

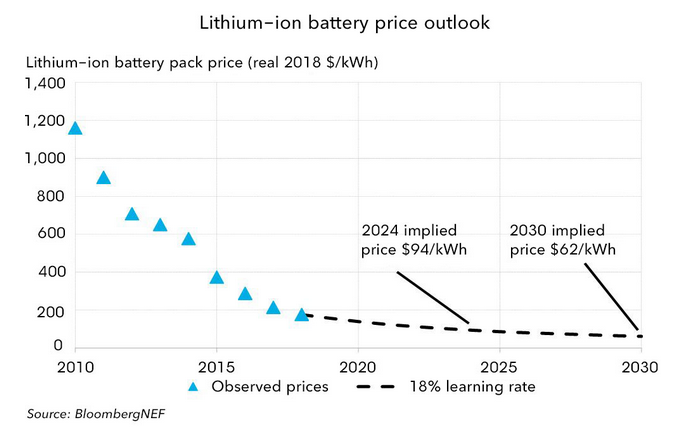

Massive research and development investment and manufacturing scale-up has driven costs down for lithium ion battery storage. This was initially driven by the consumer electronics market (e.g. cell phones and laptops) and more recently accelerated by the electric vehicle market. There has been an almost 90% reduction in $/kWh cost in the last decade and lithium ion costs are expected to continue to decrease with additional manufacturing improvements and economies of scale. Solar and wind technology cost reductions are also driving deployment of energy storage for hybrid applications. | Massive research and development investment and manufacturing scale-up has driven costs down for lithium ion battery storage. This was initially driven by the consumer electronics market (e.g. cell phones and laptops) and more recently accelerated by the electric vehicle market. There has been an almost 90% reduction in $/kWh cost in the last decade and lithium ion costs are expected to continue to decrease with additional manufacturing improvements and economies of scale. Solar and wind technology cost reductions are also driving deployment of energy storage for hybrid applications. | ||

[[File:BNEF_LiIon_Battery_Pack_Price.png|none|thumb| | [[File:BNEF_LiIon_Battery_Pack_Price.png|none|thumb|800px|Bloomberg New Energy Finance projects 2030 lithium ion pack costs at $62/kWh based on observed prices and an 18% learning rate. Source: [https://about.bnef.com/blog/behind-scenes-take-lithium-ion-battery-prices/ BNEF: "A Behind the Scenes Take on Lithium-ion Battery Prices"]]] | ||

=Increasing Renewable Generation= | =Increasing Renewable Generation= | ||

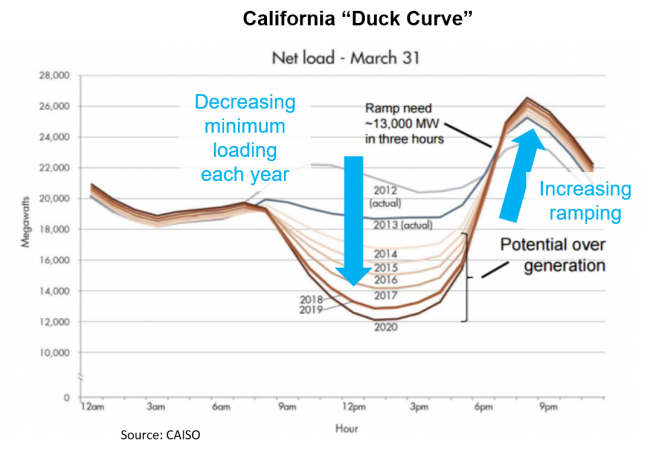

Solar photovoltaic (PV) is driving over generation | Solar photovoltaic (PV) is driving midday over generation and increased evening ramping requirements which provides a value stream for flexible energy storage. As more solar comes online, the effective net load in the middle of the day decreases. Wind energy is similarly driving flexibility needs. | ||

[[File:Caiso_Duck_Curve_Ramping.png|none|thumb|650px|Source: [https://www.caiso.com/Documents/FlexibleResourcesHelpRenewables_FastFacts.pdf CAISO: "What the duck curve tells us about managing a green grid"]]] | |||

=Evolving Utility Needs= | =Evolving Utility Needs= | ||

| Line 23: | Line 24: | ||

=Policy and Regulatory Changes= | =Policy and Regulatory Changes= | ||

==Federal Policy== | |||

[[File:Us_Fed_Regulation.png|none|thumb|800px|Overview of recent energy storage related Federal Energy Regulatory Commission (FERC) orders]] | |||

===FERC Order 755 Frequency Regulation Compensation in Organized Markets=== | |||

*Pay for Performance compensation based on speed and accuracy | *Pay for Performance compensation based on speed and accuracy | ||

===FERC Order 841 Electric Storage Participation in Markets Operated by RTOs and ISOs=== | |||

*Storage can participate in energy, ancillary services, and capacity markets when technically able | *Storage can participate in energy, ancillary services, and capacity markets when technically able | ||

*Clarifies technical provisions for energy storage | *Clarifies technical provisions for energy storage | ||

===FERC Order 845-A Reform of Generator Interconnection Procedures and Agreements=== | |||

*Revises large generator interconnection requirements | *Revises large generator interconnection requirements | ||

*Allows interconnection below combined nameplate for hybrid systems | *Allows interconnection below combined nameplate for hybrid systems | ||

===FERC Order 2222 Participation of Distributed Energy Resource Aggregations in Markets Operated by RTOs and ISOs=== | |||

*Enables Aggregated DER (or Virtual Power Plant) participation in ISO/RTO markets | *Enables Aggregated DER (or Virtual Power Plant) participation in ISO/RTO markets | ||

==U.S. State Policy== | |||

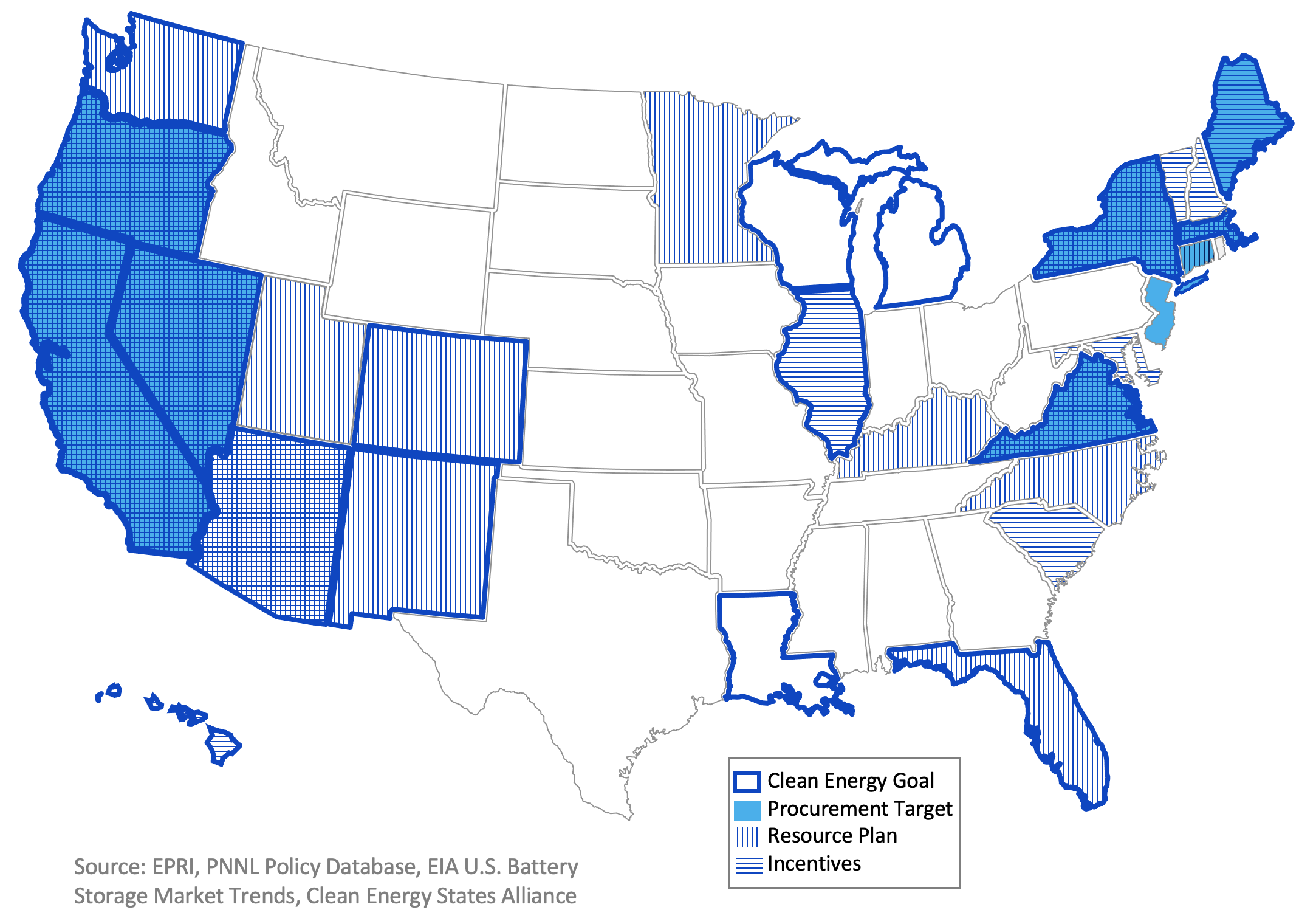

<br>States are taking varying approaches for energy storage deployment | <br>States are taking varying approaches for energy storage deployment | ||

[[File:Es101driver10.png]] | |||

*'''Procurement Targets:''' Regulators or legislators set procurement goals and mandates requiring utilities to directly procure or contract storage. | |||

*'''Incentives:''' Legislators create economic incentives (e.g. rebates or subsidies) for deploying storage; No mandatory procurement | |||

*'''Resource Plans:''' State agencies or regulators fund studies or direct utilities to create an energy plan with consideration of storage; No targets or incentives | |||

=Resources= | =Resources= | ||

Revision as of 11:18, 6 November 2020

Decreases in Technology Costs

Massive research and development investment and manufacturing scale-up has driven costs down for lithium ion battery storage. This was initially driven by the consumer electronics market (e.g. cell phones and laptops) and more recently accelerated by the electric vehicle market. There has been an almost 90% reduction in $/kWh cost in the last decade and lithium ion costs are expected to continue to decrease with additional manufacturing improvements and economies of scale. Solar and wind technology cost reductions are also driving deployment of energy storage for hybrid applications.

Increasing Renewable Generation

Solar photovoltaic (PV) is driving midday over generation and increased evening ramping requirements which provides a value stream for flexible energy storage. As more solar comes online, the effective net load in the middle of the day decreases. Wind energy is similarly driving flexibility needs.

Evolving Utility Needs

- The grid infrastructure (generation, transmission, and distribution) is sized for infrequent peak needs and therefore most assets are under-utilized most of the time. Energy storage can support peak load reduction to provide significant cost reduction opportunity to electricity customers.

- Utility asset infrastructure is aging and peak load reduction may extend asset life and offer opportunity to consider investment in new technologies.

- Peaker plants are only used a fraction of hours per year and energy storage is being considered as peaking capacity in generation planning. Battery storage is already being deployed for this application and as costs decrease they may be cost competitive with combustion turbines in the next decade. When accounting for operational benefits, the crossover point on cost may be sooner.

Increasing Utility Customer Choice and Engagement

Customers (residential, commercial, industrial) are considering energy storage for:

- Bill savings

- Increased energy independence

- Renewable energy goals

- Backup premise or critical loads

Policy and Regulatory Changes

Federal Policy

FERC Order 755 Frequency Regulation Compensation in Organized Markets

- Pay for Performance compensation based on speed and accuracy

FERC Order 841 Electric Storage Participation in Markets Operated by RTOs and ISOs

- Storage can participate in energy, ancillary services, and capacity markets when technically able

- Clarifies technical provisions for energy storage

FERC Order 845-A Reform of Generator Interconnection Procedures and Agreements

- Revises large generator interconnection requirements

- Allows interconnection below combined nameplate for hybrid systems

FERC Order 2222 Participation of Distributed Energy Resource Aggregations in Markets Operated by RTOs and ISOs

- Enables Aggregated DER (or Virtual Power Plant) participation in ISO/RTO markets

U.S. State Policy

States are taking varying approaches for energy storage deployment

- Procurement Targets: Regulators or legislators set procurement goals and mandates requiring utilities to directly procure or contract storage.

- Incentives: Legislators create economic incentives (e.g. rebates or subsidies) for deploying storage; No mandatory procurement

- Resource Plans: State agencies or regulators fund studies or direct utilities to create an energy plan with consideration of storage; No targets or incentives