Energy Storage Analysis Case Studies

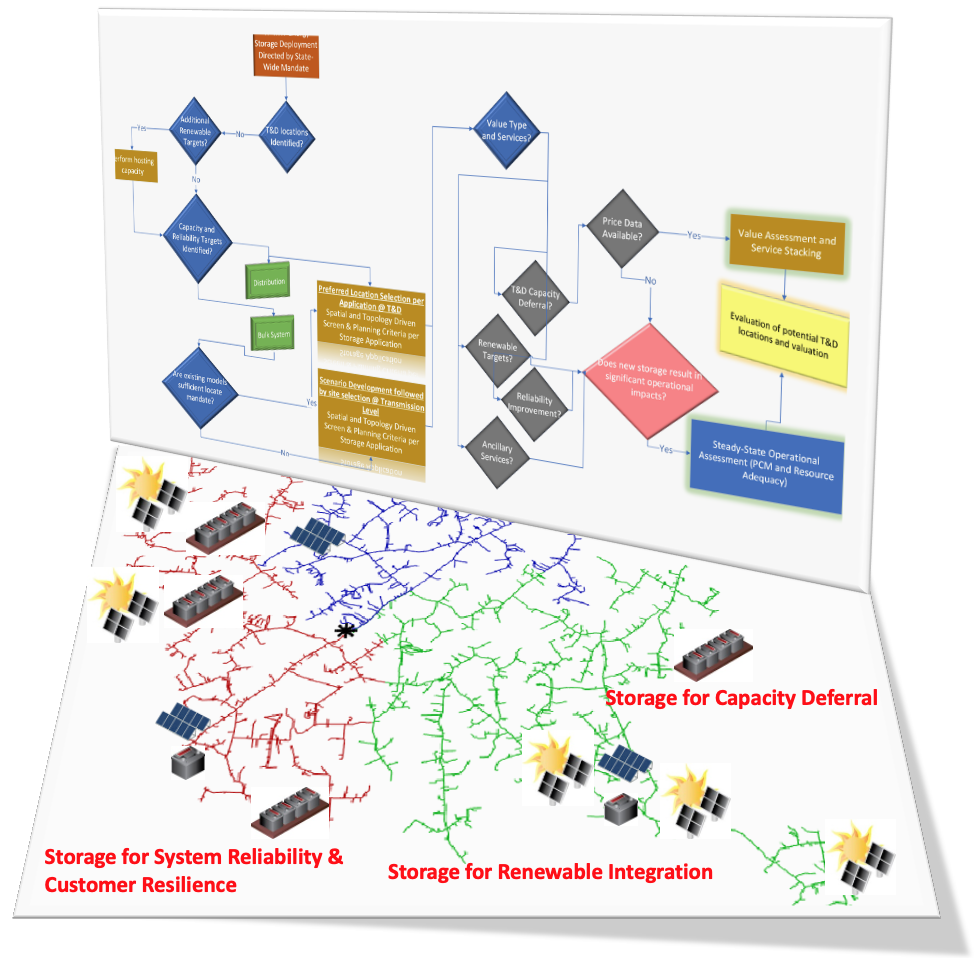

This section of the wiki contains a collection of energy storage valuation and feasibility studies that represent some of the most relevant applications for storage on an ongoing basis. Each of the analyses in this report is based on a real case study performed by EPRI. These analyses pair the Storage Value Estimation Tool(StorageVET®) or the Distributed Energy Resources Value Estimation Tool (DER-VET™) with other grid simulation tools and analysis techniques to establish the optimal size, best use of, expected value of, or technical requirements for energy storage in a range of use cases, including distribution deferral, transmission deferral, renewables integration, market participation, and microgrid applications.

For a more detailed discussion of energy storage modeling, valuation, and available tools, see the Energy Storage Valuation page.

The analysis case studies are divided by year, below.

| Description | Access | Status |

|---|---|---|

| Public Case Studies | Anyone | Being built on an ongoing basis |

| 2022 Case Studies | Program 94B (Energy Storage and Distributed Generation) | Being built on an ongoing basis |

| 2021 Case Studies | Program 94B (Energy Storage and Distributed Generation) | Complete |

| 2020 Case Studies | ||

| 2019 Case Studies |

Not every case study is available to everyone. Only years corresponding to funding for the Energy Storage and Distributed Generation program, project set B (P94B) will be accessible. The public case studies are available to everyone and are not contingent on funding.

PRIMARY AUDIENCE: Utilities who are exploring use cases for energy storage systems

KEY RESEARCH QUESTION: What are the high-value applications and associated limitations for energy storage systems on an ongoing basis as demonstrated by contemporary, relevant case studies?

RESEARCH OVERVIEW: The Storage Value Estimation Tool (StorageVET®) or the Distributed Energy Resources Value Estimation Tool (DER-VET™) was used with other grid simulation tools and analysis techniques to establish the optimal size, best use of, expected value of, or technical requirements for energy storage in a range of use cases, including distribution deferral, transmission deferral, renewables integration, market participation, and microgrid applications.was used along with transmission and distribution simulation tools and complex analysis methodologies to uncover the value and technical feasibility of energy storage systems in transmission and distribution investment deferral, market participation, and renewables integration use cases.

KEY FINDINGS:

- There are real examples where the flexibility offered by storage systems can provide an enormous amount of value relative to their cost, but careful identification, planning, and operation are required.

- When implementing very high penetrations of renewable energy, energy storage can offer a cost-effective and clean method for reconciling intermittent generation and load while maintain grid stability.

- Reconciling the differences in lifetime between storage systems and other grid assets through an approach like economic carrying cost is critical for establishing a level comparison.

WHY THIS MATTERS: Storage systems benefit from a clear definition of a primary service that is highly valuable, around which flexible, lower-value services can be stacked.

HOW TO APPLY RESULTS: The analyses in this report serve as excellent examples of technical feasibility and valuation studies for energy storage implementation EPRI software such as StorageVET and OpenDSS. They should be treated as model studies that can be replicated by the user for their own purposes. Additionally, they are a clear cross-section of highly relevant, contemporary use cases for energy storage systems that exemplify how valuable the flexibility they offer can be.

LEARNING AND ENGAGEMENT OPPORTUNITIES:

- DER-VET User Group (2021)

- Energy Storage Integration Council

EPRI CONTACTS: Miles Evans, Engineer/Scientist, mevans@epri.com

PROGRAM: Energy Storage and Distributed Generation (P94)